HeroSecondaryQuote

JSS component is missing React implementation. See the developer console for more information.

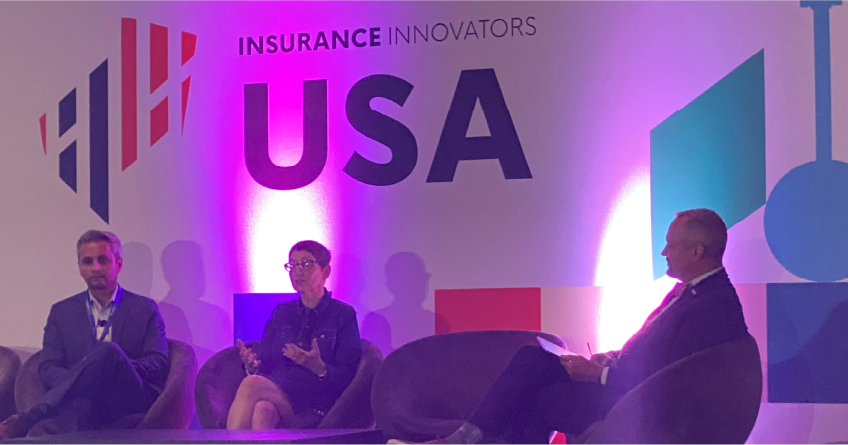

I was fortunate to have the opportunity to speak at the Insurance Innovators USA conference, which was held in Nashville, Tennessee, in late July. I joined Prashant Hinge, VP, Automation and Employee Experience, Hanover Insurance, and Jason Gross, VP, Head of Platform at ManchesterStory for a discussion about intelligent automation in insurance.

We discussed how to capitalize on the opportunities of artificial intelligence (AI), robotic process automation (RPA), and other technologies for insurers to achieve their business goals. The following are six considerations for insurers looking to innovate for modern success.

Read part one: How Forward-Thinking Insurers are Finding Success

Six things to consider for insurance process modernization

- Use technology in very targeted ways

- Start with the goal, not the technology

- Understand your processes first

- Collaboration + Experimentation = Innovation

- Incrementally improve instead of rip-and-replace

- Set up an innovation lab

Use technology in very targeted ways

Our conversation started with exploring why these technologies are so powerful–which is because they can be used in really targeted ways. The opportunity ahead is to be able to use those technologies and others, like intelligent document processing (IDP) and process mining, to solve specific challenges and achieve specific business outcomes across the traditional insurance value chain. We also touched on how they can enable insurers to really use data as part of the decision-making process at critical points in the policy and claims lifecycles. We definitely agreed that we’re only seeing the beginning of how these technologies will help insurers.

Start with the goal, not the technology

Another topic of discussion was about how the most successful deployments are the ones that were targeted towards a specific business need and had defined metrics about what would be considered successful ROI.

Great Automation Race to Insurance Innovation

IDC’s latest research about intelligent automation in insurance.

Understand your processes first

One point that really stayed with me was that when projects are deemed a failure, it’s not because the technology didn’t work; it’s most often due to organizations choosing the wrong aspect of a process to automate, simply because they didn’t truly understand their processes in the first place. Or, they didn’t clearly define the business outcomes that they were aiming to achieve.

Improve your processes with real-time insight from your own systems.

Collaboration + Experimentation = Innovation

Internal collaboration and experimentation can take years to establish, particularly in large, established insurers with strong cultures and ways of working that have served them well.

But now, it’s clear that the overnight shift to remote work and virtual customer engagement that began with the pandemic has evolved to a place where there is an understanding that insurers need to accelerate digital adoption and enhance virtual operations–finding better and more permanent solutions to addressing the processing gaps that COVID exposed.

Incrementally improve instead of rip-and-replace

Insurers need to find new approaches to improving their processes. And it’s not another rip-and-replace project. Ultimately, using technology to advance intelligent process automation is most successful when an organization defines what success looks like before a project starts. And that’s because innovative technology projects all have the potential for business value–it just depends on what your business objectives are.

Set up an innovation lab

Some companies have set up innovation labs where small groups can work on projects without the pressures and constraints of the day-to-day business environment, building new ways of working that can be scaled up and absorbed into the larger organization. This approach enables them to look at the different business areas across the enterprise and figure out what technologies will have the most business impact.

This incubator approach can also help to define possible organizational changes that can promote collaboration, and insurers should facilitate ways to help people share ideas and knowledge freely–encouraging that lessons learned from both success and failure are part of an ongoing conversation about process improvement, and most importantly, recognizing innovation efforts even when they fall short of success.

The most successful organizations will be the ones that find ways to embed innovation into their culture and empower their teams–both individually and collectively–to challenge the way things have always been done, and encourage, support, and reward innovative behavior across the silos of an enterprise.

Subscribe for blog updates

RelevantBlogPosts

JSS component is missing React implementation. See the developer console for more information.

ConnectWithUs

JSS component is missing React implementation. See the developer console for more information.