Electronic invoices

Integrate e-invoices within your AP automation with ease

What is e-invoicing?

Electronic invoicing (e-invoicing) is a digital way of sending and receiving invoices between suppliers and buyers. Unlike PDF or paper invoices, e-invoices are structured data files (usually in XML format) that can be automatically processed by software systems.

Many countries around the world are adopting e-invoicing to reduce tax fraud, improve efficiency, and promote sustainability. In the European Union, e-invoicing is mandatory for public sector transactions, and some countries have extended this requirement to the private sector as well. Businesses that deal with cross-border trade need to comply with different e-invoicing regulations in each market and a multitude of standards such as ZUGFeRD / Factur-X, XRechnung, FatturaPA, FacturaE, Svefaktura, UBL (Universal Business Language), and PEPPOL BIS Billing.

Integrating e-invoices into AP automation

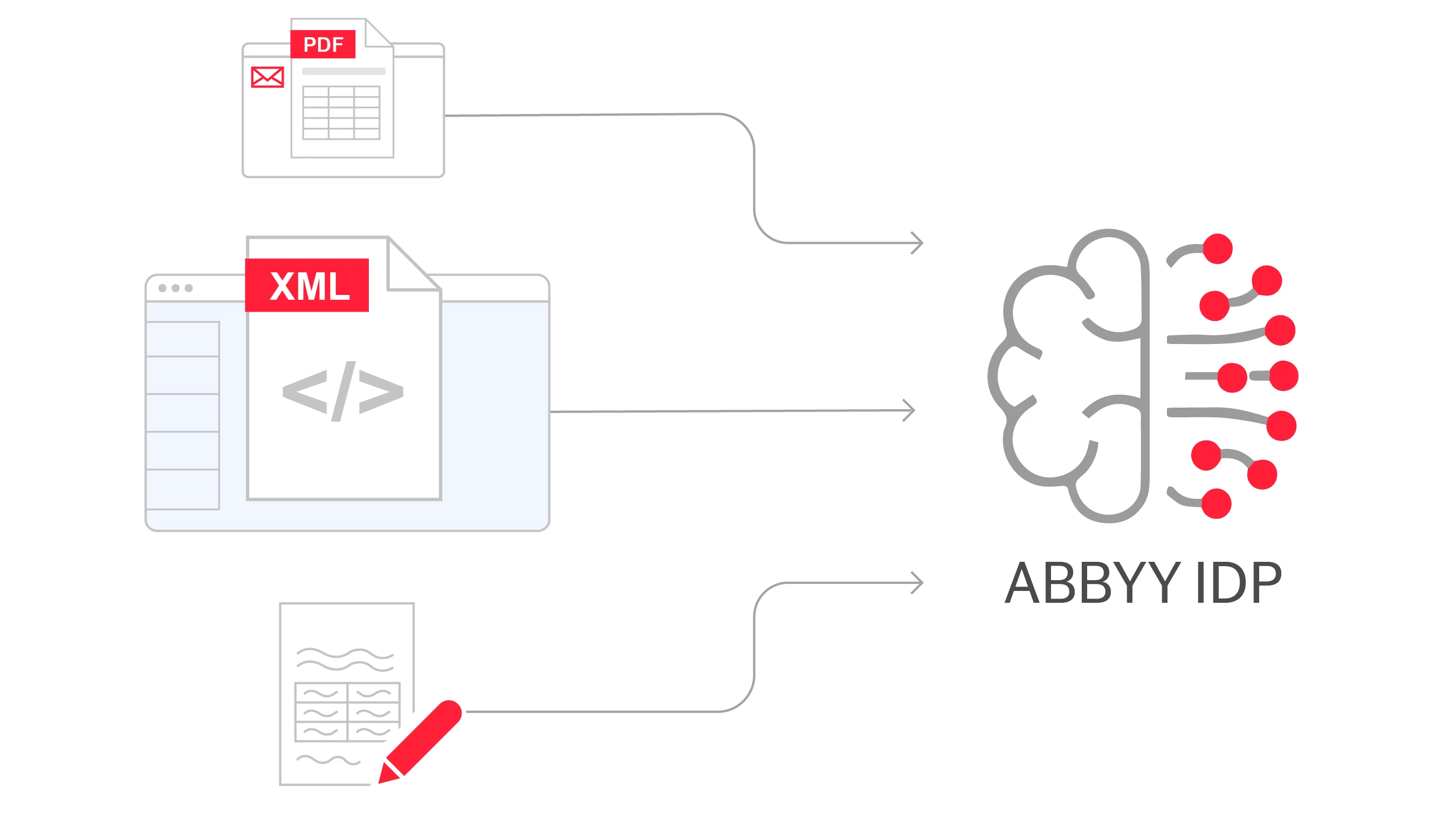

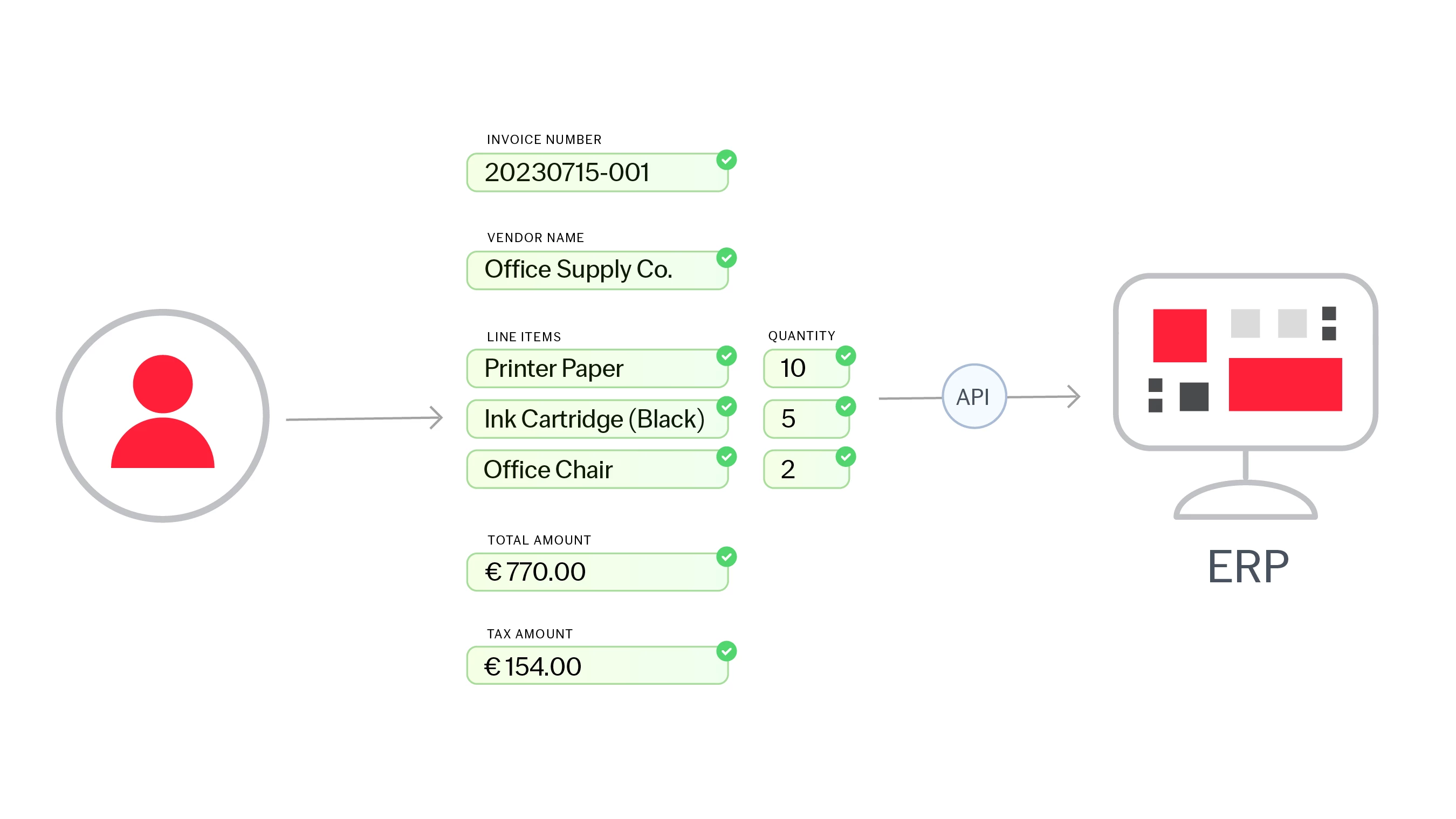

By integrating e-invoicing into AP automation, businesses can benefit from faster and more accurate invoice processing, lower operational costs, higher compliance and security, and better cash flow management. ABBYY's purpose-built intelligent document processing (IDP) solutions enable businesses to handle any type of invoice, whether electronic, paper, or PDF, within one single platform. ABBYY IDP leverages artificial intelligence to extract, normalize, and validate data from invoices, and seamlessly integrate with ERP systems via API.

With ABBYY IDP, businesses can easily adhere to obligations to accept and process electronic invoices while remaining equipped to handle the complexity of international trade.

Efficient invoice processing in a unified workflow

AI-based AP automation

Compliance with e-invoicing mandates

Easy connection to your business ecosystem

Processing e-invoices with purpose-built AI

Any invoice type, any format: one streamlined process

Effortless ingestion of e-invoices from any source

Compliance with global e-invoicing standards

Design custom models to support more standards

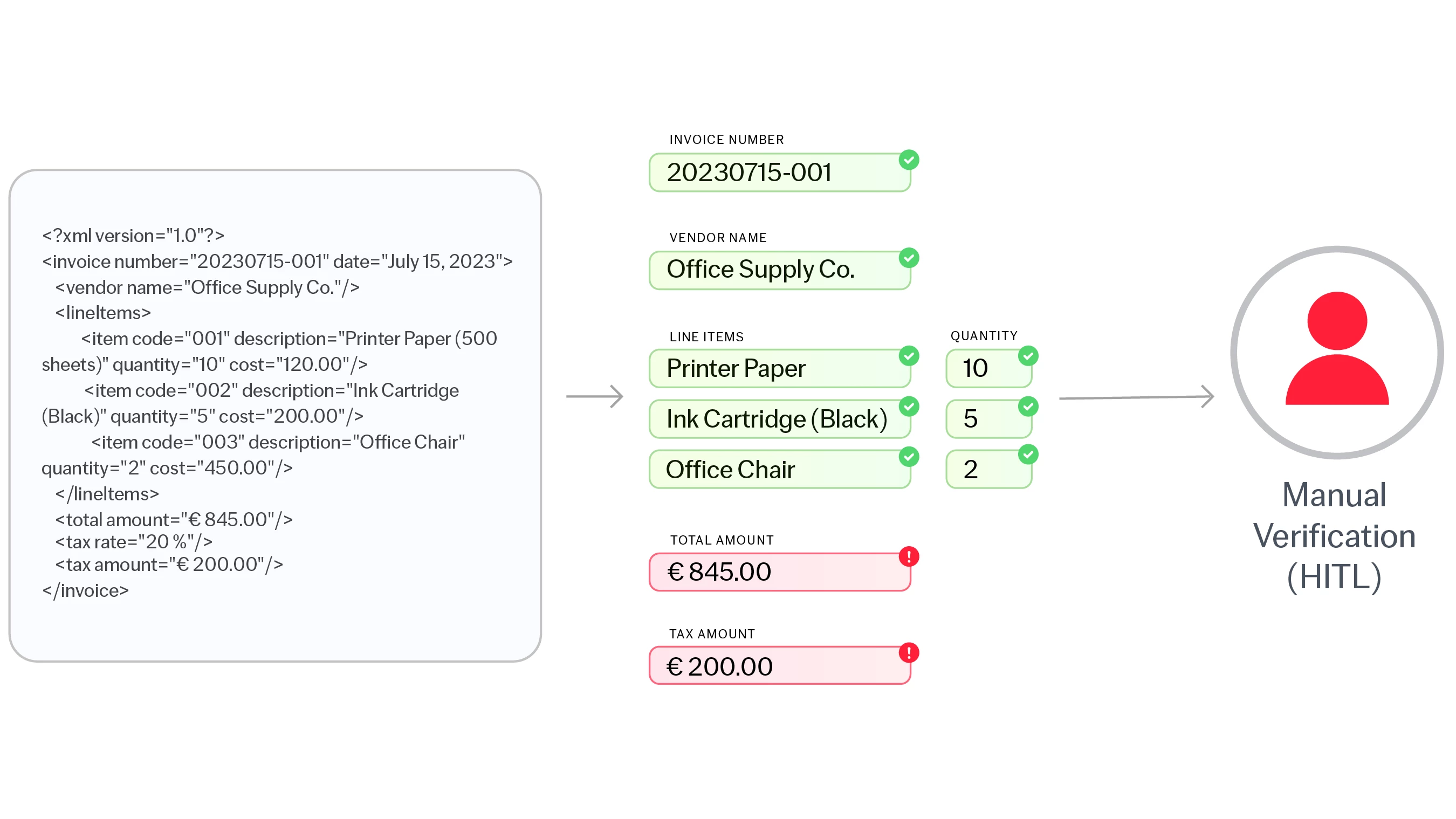

Data validation based on business rules

Human in the loop (HITL) verification

Data export and archiving

How does e-invoice processing work?

- Ingest invoices

- Extract and validate data

- Export to ERP

Ingest invoices

Extract and validate data

Export to ERP

Article: A Guide to E-invoicing in Accounts Payable

Learn more about Accounts Payable automation with ABBYY

Article: How AI in Accounts Payable Is Transforming AP Automation to Achieve Best-in-Class Results

Article: Are You Ready for e-Invoicing? Use Purpose-Built AI to Manage All Invoice Formats

Article: A Guide to E-invoicing in Accounts Payable

Learn more about Accounts Payable automation with ABBYY

Article: How AI in Accounts Payable Is Transforming AP Automation to Achieve Best-in-Class Results

Article: Are You Ready for e-Invoicing? Use Purpose-Built AI to Manage All Invoice Formats

FAQ

What is electronic invoicing (e-invoicing)?

Electronic Invoicing (e-invoicing) is the digital exchange of invoices that follow a structured, machine-readable data format (such as JSON or XML) and can be automatically imported into the buyer’s ERP system without manual data keying.

Per definition, the main goal of an e-invoice is the automated import into the AP system. A visual representation of the data in a human-readable format (such as PDF) is, while possible, secondary, not obligatory, and not considered part of the invoice.

What are the most common e-invoicing formats and standards?

- EDIFACT - Used internationally, particularly in Europe, for electronic data interchange.

- UBL (Universal Business Language) 2.0 - Developed by OASIS, UBL is widely used and includes standards for various business documents in addition to invoices.

- ZUGFeRD - A format popular in Germany that combines PDF and XML data for invoices.

- FacturaE - The mandatory standard in Spain for invoicing within the public sector.

- PEPPOL BIS Billing 3.0 - Used by the PEPPOL network for cross-border transactions within Europe.

- eFFF (Electronic Flexible File Format) - Used in Belgium, accommodating various business document types.

- Svefaktura - Used in Sweden, particularly for transactions involving the public sector.

- FatturaPA - The standard format for electronic invoices in Italy, specifically for public administration transactions.

- ANSI X12 - A standard widely used in North America for EDI transactions, including invoicing.

How does ABBYY IDP help with e-invoicing?

Is electronic invoicing mandatory?

What are the benefits of using IDP for processing e-invoices?

Processing e-invoices with IDP can bring many benefits to businesses, such as:

- Providing a unified process for hybrid invoice streams (electronic, PDF, paper).

- Reducing manual labor and errors, by automating the data capture and extraction from all types of invoices in one single workflow, regardless of their format and layout.

- Improving compliance and security, by ensuring that the e-invoices are validated against the relevant rules and agreements.

- Normalizing data from invoices of different types (PDF, paper, electronic) and different e-invoice standards (ZUGFeRD / Factur-X, XRechnung, FatturaPA, FacturaE, Svefaktura, UBL, PEPPOL BIS Billing etc.) for seamless integration into downstream systems such as ERP.

Request a demo today!

Schedule a demo and see how ABBYY intelligent automation can transform the way you work—forever.

StickyCTAButton

JSS component is missing React implementation. See the developer console for more information.